National Bank/Lincoln NB, Rochester, NY (Charter 8026)

National Bank/Lincoln NB, Rochester, NY (Chartered 1905 - Liquidated 1920)

Town History

Rochester is a city in and the county seat of Monroe County, New York. It is the fourth-most populous city in New York with a population of 211,328 at the 2020 census, while the Rochester metropolitan area in Western New York has an estimated 1.06 million residents and is the 54th-largest metropolitan area in the U.S. Throughout its history, Rochester has acquired several nicknames based on local industries; it has been known as "the Flour City" and "the Flower City" for its dual role in flour production and floriculture, and as the "World's Image Center" for its association with film, optics, and photography.

The city was one of the United States' first boomtowns, initially due to the fertile Genesee River valley which gave rise to numerous flour mills, and then as a manufacturing center, which spurred further rapid population growth. Rochester has also played a key part in US history as a hub for social and political movements, especially abolitionism, and the women's rights movement.

Rochester is the birthplace and/or home of many notable companies including Eastman Kodak, Xerox, Bausch & Lomb, Wegmans, Constellation Brands, Gannett, Paychex, and Western Union. In part due to their influence, the region became a global center for science, technology, and research and development. This has been aided by the presence of several internationally renowned universities, notably the University of Rochester and Rochester Institute of Technology (RIT), and their research programs; these schools, along with many other smaller colleges, have played an increasingly large role in its economy. The city experienced significant population decline due to deindustrialization in the late 20th century, although less severely than its Rust Belt peers. The Rochester metropolitan area is the third-largest regional economy in New York, after New York City and Buffalo–Niagara Falls.

Rochester is also known for its culture; in particular, the Eastman School of Music, one of the most prestigious conservatories in the world, and the Rochester International Jazz Festival anchor a vibrant music industry. It is the site of several museums such as The Strong National Museum of Play and the George Eastman Museum, which houses the oldest photography collection in the world.

Rochester had 11 National Banks chartered during the Bank Note Era, and all 11 of those banks issued National Bank Notes.

Bank History

- Organized December 4, 1905

- Chartered December 29, 1905

- Opened for business January 2, 1906

- 1: Succeeded German-American Bank and 1362 (Flour City National Bank, Rochester, NY)

- 1: Absorbed Commercial Bank May 1906

- 2: Liquidated December 1, 1920

- 2: Consolidated with Alliance Bank of Rochester

On Wednesday, March 8, 1905, directors of the Rochester German Insurance Company met primarily for the purpose of electing a successor to the late Frederick Cook who was president of the company for the past 20 years. The directors elected Eugene Satterlee president. Mr. Satterlee was elected attorney for the company in 1880 and later became second vice president and for the past four years first vice president. He was the head of the law firm of Satterlee, Bissell, Taylor and French in the German Insurance building. He was also vice president of the German American Bank, president of the Stromberg-Carlson Telephone Manufacturing Co., vice president of the Rochester Telephone Co., a director of the Rochester Trust and Safe Deposit Co. as well as various other Rochester corporations. He was the first man not of German descent to become a director of the insurance company. The Rochester German Insurance Co. was organized in February 1872 with Louis Bauer as its first president. Mr. Bauer was succeeded by Colonel Louis Ernst, and 27 years ago, Frederick Cook was elected president. Mr. Cook died on February 17th.[4]

At the close of business, June 7, 1905, the German-American Bank had total resources of $6,680,513.95, with capital $500,000, surplus and undivided profits $810,525.57, and deposits $5,366,488.38. Eugene Satterlee was president; Albrecht Vogt, vice president; Edward Bausch, second vice president; and William B. Farnham, assistant cashier.[5] The bank was located at located at No. 19, West Main Street, Rochester.

By December 23, 1905, all of the national and state banks that paid dividends at the beginning of the year had declared them except the Flour City National which would combine its regular dividend with its dissolution dividend to be paid about January 1st. The Flour City and the German American banks would declare their last dividends some time in the coming week as through their merger, the National Bank of Rochester would be formed.[6]

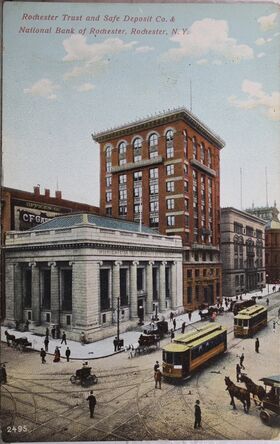

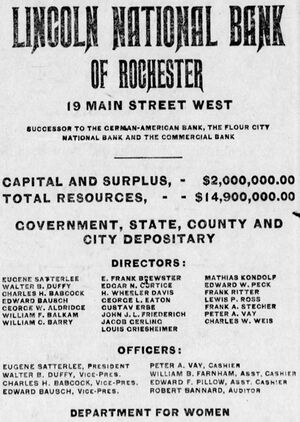

On Tuesday, January 2, 1906, the National Bank of Rochester, the financial institution formed by the merging of the German-American Bank and the Flour City National Bank, would open for business at No. 19 Main Street West at 10 o'clock a.m. The officers of the new bank were Eugene Satterlee, president; Walter B. Duffy, Albrecht Vogt, and Edward Bausch, vice presidents; Peter A. Vay and William B. Farnham, assistant cashiers. The directors were Eugene Satterlee, Walter B. Duffy, Albrecht Vogt, Edward Bausch, George W. Aldridge, William C. Barry, E. Franklin Brewster, William F. Balkam, Gustav Erbe, John J.L. Friederich, Jacob Gerling, Louis Greisheimer, George W. Ham, Granger A. Hollister, Mathias Kondolf, Edward W. Peck, James Breck Perkins, Frank Ritter, Frank A. Stecher, Charles W. Wels, and George L. Eaton. On December 29th, letters were sent by the two banks to their patrons announcing that their balances would be transferred to the books of the National Bank of Rochester on the close of business on December 30th and that a new passbook would be issued. The letter from the German-American Bank was signed by Eugene Satterlee, president; that of the Flour City National Bank by Walter B. Duffy, president; William C. Barry, vice president; E. Frank Brewster, vice president; and Peter A. Vat, cashier. Of the ten-story building at No. 19 Main Street West, the bank occupied almost the whole lower story, most of the basement and a mezzanine floor off the banking room. The narrow old building had been transformed in the new structure. The same materials had been employed in the exterior as in the original structure--red brick and a brownish sandstone--a new character was introduced using heavy polished green granite columns at the entrance and the panels in the same material between the upper windows. In the interior, marble and bronze were employed. The vestibule was lined with Knoxville marble, not in slabs, but built into the structure in courses of blocks, tooled to an antique finish. The elevator lobby and the banking room were walled in the same manner with polished citron-veined Norwegian marble. The elevator screens and various sets of doors were all of statuary bronze, especially designed by the architects. The lower portion of the screen in the banking room was of Skyros marble quarried upon the small island of that name in the Adriatic.

The front of the banking room was raised one step for the cashier and president and separated from the public space by only a low rail. A private elevator afforded access to the vaults in the basement, the mezzanine above the banking room and the directors' room on the second floor. The women's department was on the right of the entrance to the building. Besides a reception room 16 by 18 feet square, there was a smaller alcove room, a private ante-room and a toilet.

The directors' room, to be used by the directors of both the Rochester German Insurance Co. and the National Bank of Rochester, was 20 X 26 feet and was wainscoted to the spring of the vaulted ceiling with English oak. A monumental green marble mantel filled one end. The floor was of teakwood laid in a herring-bone pattern. The directors' table was an interesting feature of the room, having been designed with the chairs for this specific purpose. The ceiling was decorated in light buff and gold, the chairs upholstered in green leather, and a heavy imported rug of green with a dull gold border relieved the tone of the floor and walls.[7]

On April 6, 1906, stockholders of the Commercial Bank of Rochester received waivers of rights to subscribe for additional stuck under the proposed increase in the capital stock of the National Bank of Rochester. Under the National Bank Act, any national banking association, with the approval of the comptroller of the currency and by vote of two-thirds of shareholders, increase its capital stock. All shareholders have the right to subscribe for additional stock in all increases pro rata to their holdings. Waivers were to surrender the right to subscribe to the new issue. The plan was to increase capital stock from $800,000 to $1,000,000. This was the plan also used to carry out the merger of the German-American Bank and the Flour City National Bank.[8] On April 17th, stockholders of the National Bank of Rochester approved the increase in capital stock by $200,000. The increase was to enable the national bank to take over the Commercial Bank. The next step would be the special meeting of stockholders of the Commercial Bank to be held Friday afternoon, April 27th, according toe C.H. Babcock, president of the Commercial Bank.[9] On Saturday, April 28th, the Commercial Bank lost its identity and were closed at noon. The period of liquidation would begin at once. Officers and employees of the old Commercial Bank would be with the National Bank of Rochester as their services were needed because of the addition of its business to the bank. The merger resulted in the largest bank of discount between New York and Buffalo and there was but one similar bank in Buffalo with a larger capital.[10]

On April 30, 1891, the Commercial National Bank of Rochester reorganized as a state bank. Under the state law all assets and liabilities of the dissolved Commercial National Bank were vested without transfer and immediately in the succeeding Commercial Bank of Rochester, New York.[11] The Commercial National Bank received its charter (No. 2383) on May 8, 1878, having succeeded the Commercial Bank of Rochester.

The stockholders of the National Bank of Rochester met on April 2d, 1909, and, without a dissenting vote, ordained that the name of the institution hereafter be Lincoln National Bank of Rochester. It was the wish on the part of stockholders that the bank should bear a more distinctive name and with their desire to pay a tribute to the memory of Abraham Lincoln. The First National Bank of Rochester could not be used because of the rules laid down by the Comptroller of the Currency. Such a designation indicated the first national bank organized in any locality in point of time. No bank in Rochester, unless the law changed, could ever bear that title. The officers were Eugene Satterlee, president; Walter B. Duffy, Charles H. Babcock, and Edward Bausch, vice presidents; Peter A. Vay, cashier; William B. Farnham and Edward F. Pillow, assistant cashiers; and Robert Bannard, auditor.[12]

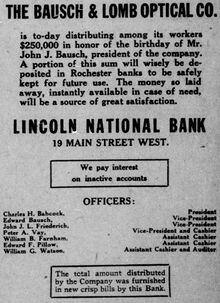

In July 1920, the officers of the Lincoln National Bank were Charles H. Babcock, president; Edward Bausch and John J.L. Friederich, vice presidents; Peter A. Vay, vice president and cashier; William B. Farnham and Edward F. Pillow, assistant cashiers; and William G. Watson, assistant cashier and auditor. The Bausch & Lomb Optical Co. distributed $250,000 among its works in honor of the birthday of Mr. John J. Bausch, president of the company. Employees were encouraged to deposit a portion in Rochester banks for future use. The total amount distributed by the company was furnished by the Lincoln National Bank in crips bills.[13]

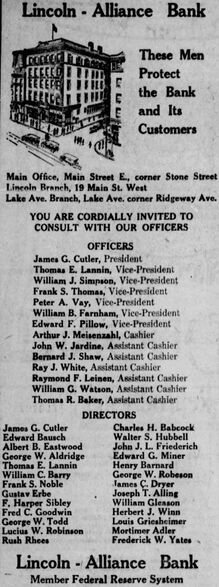

On Wednesday, December 1, 1920, the Alliance and Lincoln National banks began business under its new organization, the merger having been completed the previous afternoon with election of officers and a board of 26 directors. James G. Cutler, president of the Alliance Bank for nine years, was elected president of the new institution. The new bank in point of financial resources and banking facilities was one of the largest in New York and Buffalo. Capital and surplus aggregated $4,000,000 and total resources were approximately $40,000,000. The number of accounts was nearly 35,000.

The Lincoln-Alliance Bank would operate three organizations under central management. The main office would be at Main Street East and Stone Street, home of the Alliance Bank. The interior had recently been enlarged. The second floor of the building was occupied by the foreign exchange, stock transfer, credit and other working departments, leaving the main floor for the women's department, tellers' departments, note department, safe-deposit vaults and officers' quarters. The personnel of the main office would include the entire staff of the Alliance Bank. The former Lincoln National Bank would be operated as the Lincoln branch and the quarters in the Insurance Building would be occupied until July 1, 1921, when the lease would expire. A new location in the immediate vicinity would be provided. The Lake Avenue branch at Lake and Ridgeway Avenues would continue. This was established a few months ago by the Alliance Bank to meet the needs of business interests and residents in the Kodak section. With a capital and surplus of $4,000,000 the new institution was better prepared to provide accommodations for some of the larger interests in the city. The new bank was the only state bank in Rochester that was a member of the Federal Reserve system, retaining the membership voluntarily secured by the Alliance Bank.

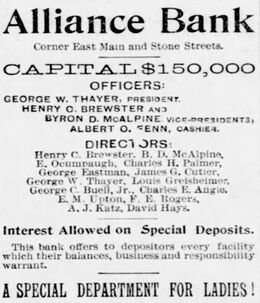

Alliance Bank first opened for business on June 1, 1893 in the building at the southwest corner of Main Street East and Stone Street, occupied by the old Eggleston Hotel. The bank had a capital of $150,000 and surplus of $15,000. George W. Thayer was its first president. Six years later in 1899 the bank acquired the property on the opposite corner of Main Street East and Stone Street, the president site, and occupied it. On November 13, 1900, the bank increased its capital to $275,000 and consolidated with the Bank of Monroe. The women's department was established in 1893, the bank following closely upon the innovation made by the Fifth Avenue Bank of New York. In 1901 a stock transfer department was added and later departments for the sale of Liberty bonds and War Savings Stamps, and fee furnishing advice and assistance in the preparation of income tax returns were opened. Mr. Cutler was the only surviving member of the first board of directors of Alliance Bank. He was elected vice president in 1894 and president in 1911.[15]

The directors of the Lincoln-Alliance Bank were James G. Cutler, Edward Bausch, Albert B. Eastwood, George W. Aldridge, Thomas E. Lannin, William C. Barry, Frank S. Noble, Gustav Erbe, F. Harper Sibley, Fred C. Goodwin, George W. Todd, Lucius W. Robinson, Rush Rhees, Charles H. Babcock, Walter S. Hubbell, John J.L. Friederich, Edward G. Miner, Henry Barnard, George W. Robeson, James C. Dryer, Joseph T. Alling, William Gleason, Herbert J. Winn, Louis Griesheimer, Mortimer Adler, and Frederick W. Yates. The officers were James G. Cutler, president; Thomas E. Lannin, William J. Simpson, Frank S. Thomas, Peter A. Vay, William B. Farnham, and Edward F. Pillow, vice presidents; Arthur J. Meisenzahl, cashier; John W. Jardine, Bernard J. Shaw, Ray J. White, Raymond F. Leinen, William G. Watson, and Thomas R. Banker, assistant cashiers.[16]

On December 16, 1920, Charles H. Babcock, member of the State Forest Preserve Board under Governors Black, Roosevelt and Odell, president of the Lincoln National Bank of Rochester until its merger this year with the Alliance Bank, and well-known coal dealer, died at his home, age 72 years.[17]

On November 26, 1947, William G. Watson, 78, former vice-president of the Lincoln-Rochester Trust Company, died. His death split a brother team believed to have been unique in American banking. Mr. Watson and his twin, Robert C. Watson, entered the banking business as messengers for different banks on the same day 58 years ago. William Watson was vice president of the Lincoln-Alliance Bank in 1945 when it merged with the Rochester Trust and Safe Deposit Company of which his brother was president. He continued as vice president of the merged bank until his retirement last year.[18]

Official Bank Titles

1: The National Bank of Rochester, NY

2: Lincoln National Bank of Rochester, NY (4/7/1909)

Bank Note Types Issued

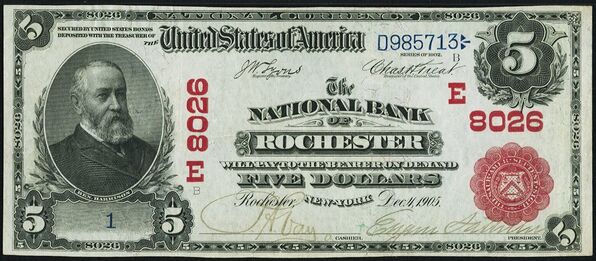

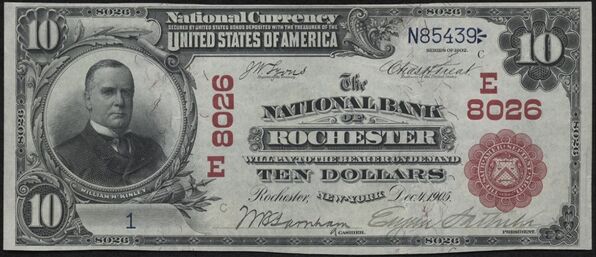

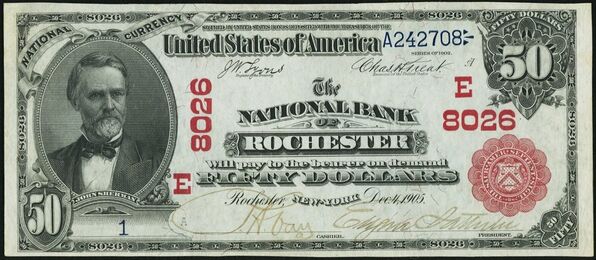

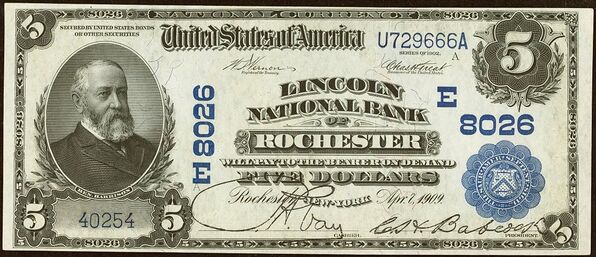

A total of $6,862,170 in National Bank Notes was issued by this bank between 1905 and 1920. This consisted of a total of 812,184 notes (812,184 large size and No small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments 1: 1902 Red Seal 4x5 1 - 20000 1: 1902 Red Seal 4x10 1 - 4500 DEFG plate approved Sep 10, 1906 1: 1902 Red Seal 3x10-20 1 - 12000 1: 1902 Red Seal 50-100 1 - 800 1: 1902 Date Back 4x5 1 - 8440 1: 1902 Date Back 4x10 1 - 1335 1: 1902 Date Back 50-100 1 - 170 2: 1902 Date Back 4x5 1 - 60000 2: 1902 Date Back 3x10-20 1 - 44400 2: 1902 Date Back 50-100 1 - 500 2: 1902 Date Back 3x50-100 1 - 987 2: 1902 Plain Back 4x5 60001 - 91991 2: 1902 Plain Back 3x10-20 44401 - 63058

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1905 - 1920):

Presidents:

Cashiers:

Other Known Bank Note Signers

Bank Note History Links

Sources

- Rochester, NY, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ Democrat and Chronicle, Rochester, NY, Thu., May 6, 1909.

- ↑ Democrat and Chronicle, Rochester, NY, Fri., July 23, 1920.

- ↑ Democrat and Chronicle, Rochester, NY, Sun., Dec. 12, 1920.

- ↑ Democrat and Chronicle, Rochester, NY, Thu., Mar. 9, 1905.

- ↑ Democrat and Chronicle, Rochester, NY, Sat. June 10, 1905.

- ↑ Democrat and Chronicle, Rochester, NY, Sat., Dec. 23, 1905.

- ↑ Democrat and Chronicle, Rochester, NY, Mon., Jan. 1, 1906.

- ↑ Democrat and Chronicle, Rochester, NY, Sat., Apr. 7, 1906.

- ↑ Democrat and Chronicle, Rochester, NY, Wed., Apr. 18, 1906.

- ↑ Democrat and Chronicle, Rochester, NY, Mon., Apr. 30, 1906.

- ↑ Democrat and Chronicle, Rochester, NY, Mon., June 29, 1891.

- ↑ Democrat and Chronicle, Rochester, NY, Thu., Apr. 8, 1909.

- ↑ Democrat and Chronicle, Rochester, NY, Fri., July 23, 1920.

- ↑ Democrat and Chronicle, Rochester, NY, Sat., Dec. 22, 1894.

- ↑ Democrat and Chronicle, Rochester, NY, Wed., Dec. 1, 1920.

- ↑ Democrat and Chronicle, Rochester, NY, Sun., Dec. 12, 1920.

- ↑ Elmira Star-Gazette, Elmira, NY, Fri., Dec. 17, 1920.

- ↑ Daily Sentinel, Rome, NY, Wed., Nov. 26, 1947.